Forex is associated with active trading, very active trading, sticking the nose to the screen. There’s an option to invest in forex trading – not buying a currency and sitting on it, but rather investing your money with successful forex traders that trade for you – the same way as putting your money with mutual funds.

With mutual funds that specialize in stocks, you invest in trusted investment houses. They buy and sell stocks for you, and for others. Good mutual funds outperform the markets. For example, they specialize in S&P or Nasdaq stocks, and have a better yearly yield than these indices.

They enable you to invest in stocks without the hassle of buying and selling stocks by yourself. But not all mutual funds are equal – sometimes they under perform and have a yield lower than the stocks they specialize in.

And sometimes stocks just go down.

In forex trading, there’s always a currency that goes up, rising against another currency. This is one of the main drivers of traders into forex trading. Good traders buy and sell currency pairs in different frequencies, and profit off the changes in prices.

But not everyone is up for active trading.

Forex trading consumes time, and some traders get addicted to it. Sticking the nose to the screen and watching every pip move up or down is too common with traders.

The solution is investing in forex traders who are successful experts. They trade all the time, you automatically follow them and make profits off forex trading without the hassle.

But good forex traders are hard to find.

Yes, some 75% to 95% of retail traders lose money. If you follow the losing ones, you lose money the same way that you lose money with underperforming mutual funds that specialize in stocks.

There are quite a few services offering the trader the option to automatically follow traders. My favorite is

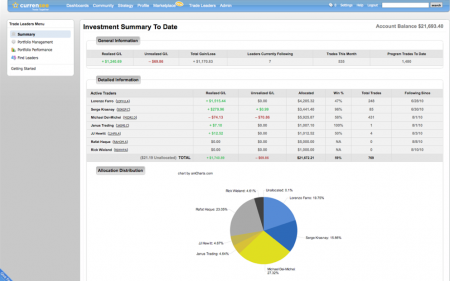

Currensee. Why? Not only because I’m affiliated with them. Their program, which is still rather new, is built up of important components that are very promising:

- The professional traders trade in their own, real, live account. No demo accounts are involved. The leader’s success is your success.

- Currensee is regulated by the British FSA, one of the toughest regulatory bodies out there.

- They cherry picked the trade leaders which you can follow – they are ranked not only on their performance, but also on their risk.

- Trade leaders’ performance is monitored on a daily basis, meaning that profitability is kept high. Profitability is compared with the S&P index.

- The investor has full control over which traders he follows, sees every single action made by the trade leader (including slippage) , and can change the amount of money invested in every leader easily.